The Great Debate: Renting or Buying, Who Wins in the End?

The Power of Real Estate: A 24-Year Journey from 2000 to 2024

The debate between buying a house and renting an apartment is as old as time. However, the long-term financial implications of this decision are often understated. To illustrate this, let’s explore the financial journeys of two hypothetical individuals, both 30 years old in the year 2000.

Scenario Analysis

The Home Buyer’s Journey (Person A)

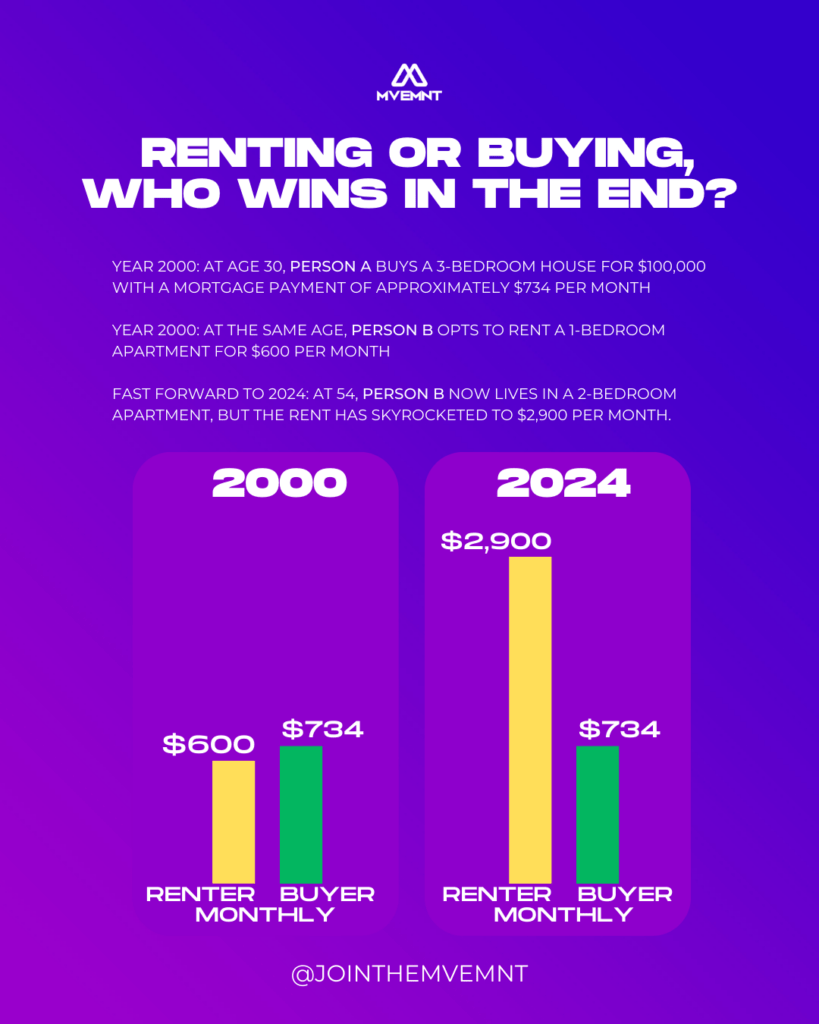

- Year 2000: At age 30, Person A buys a 3-bedroom house for $100,000 with a mortgage payment of approximately $734 per month.

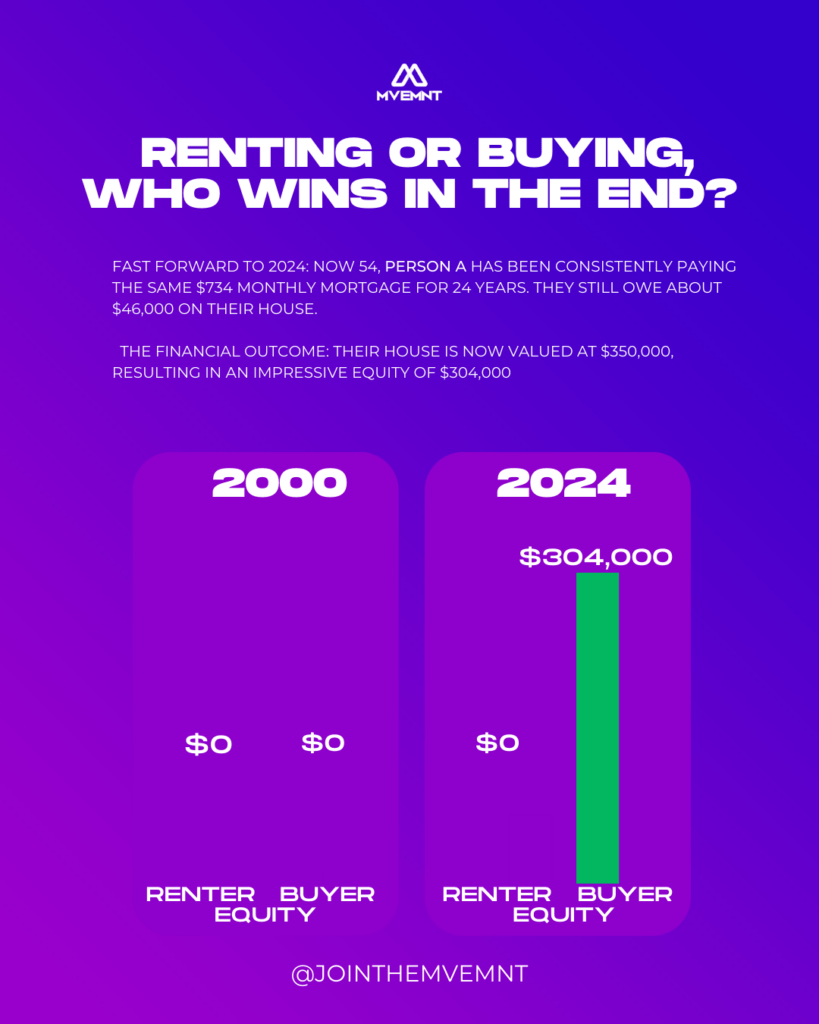

- Fast Forward to 2024: Now 54, Person A has been consistently paying the same $734 monthly mortgage for 24 years. They still owe about $46,000 on their house.

- The Financial Outcome: Their house is now valued at $350,000, resulting in an impressive equity of $304,000.

The Renter’s Journey (Person B)

- Year 2000: At the same age, Person B opts to rent a 1-bedroom apartment for $600 per month.

- Fast Forward to 2024: At 54, Person B now lives in a 2-bedroom apartment, but the rent has skyrocketed to $2,900 per month.

- The Financial Outcome: Unlike Person A, Person B has not built any equity. Their financial gain depends on how well they’ve managed to save and invest their money elsewhere.

Analysis

- Equity Building: Person A’s decision to buy a house has enabled them to build substantial equity. This equity can be leveraged for future financial endeavors or retirement funding.

- Inflation and Rent Increase: Person B’s situation highlights the unpredictability and often upward trajectory of rental prices. What started as a seemingly more affordable option has become a significant monthly expense, without contributing to any asset accumulation.

- Long-term Financial Security: Owning property like Person A often translates to long-term financial security and can be crucial to generational wealth. In contrast, renters like Person B may find themselves vulnerable to market changes without tangible assets.

While the choice between buying and renting is deeply personal and depends on various factors, the long-term financial benefits of owning property are undeniable. This example from 2000 to 2024 vividly demonstrates how owning a home can significantly contribute to one’s wealth and financial security. It’s a decision that shouldn’t be taken lightly, but the potential benefits make it a goal worth considering for those striving for long-term financial stability and growth. Remember, in the realm of personal finance, property often equates to wealth.

NACA: The Path to Homeownership Without Downpayments or Credit Checks

Featured Listings

8 Black Women-Owned Businesses to Support in the DMV This Month

The DMV is home to an incredible number of Black women entrepreneurs...

How the New Tariffs Will Impact Your Everyday Life—From Margaritas to Gas Prices

The U.S. has rolled out new tariffs on imported goods, and while...

2025 Budget: What It Means for Black America

If you’ve ever had to stretch a paycheck, rely on Medicaid for...

Bridge the Credit Gap: How to Boost Credit Score and Elevate Your Financial Life

In today’s economy, good credit is more than just a number—it’s the...

Leave a comment